Aminex

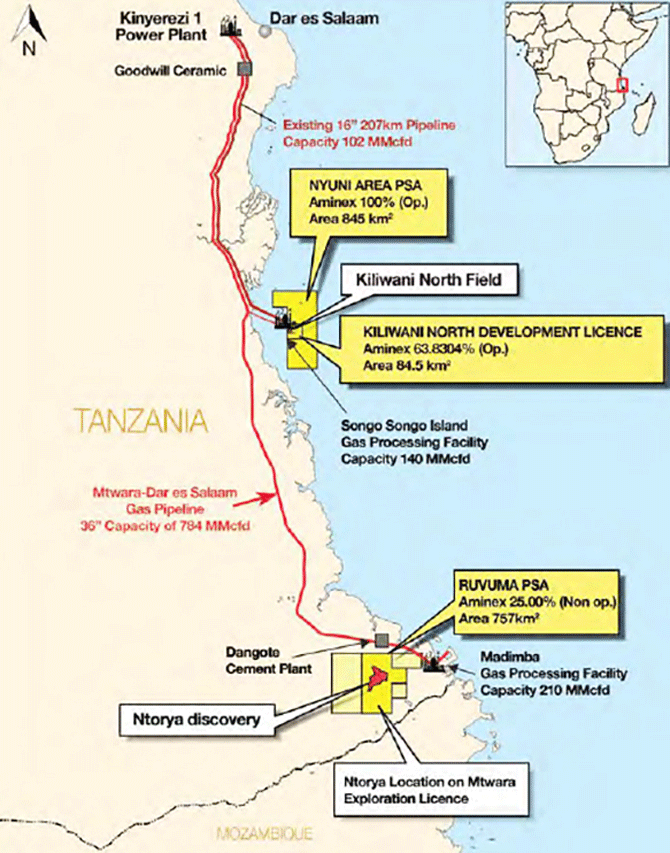

THE REAPPOINTMENT last month of Bob Ambrose as a director of Aminex is a real signal that the potential game-changer well – Chikumbi-1 (CH-1), which had originally been planned for last November – will actually be spudded this autumn. Alongside the 35-km gas pipeline that state energy company Tanzania Petroleum Development Corporation (TPDC) is constructing from Aminex’s Ntorya gas discovery block to the nearby Madimba gas processing facility, it is beginning to look as if Aminex is at last progressing to turn this big gas discovery into a valuable asset. With limited downside, investors will be tempted to get in before the results are announced.

When Brian Hall signed the Ruvuma farm-out deal back in August 2018, he was convinced he had secured the future of Aminex as this $140m development agreement secured funding for the whole project, not just the drilling of the step-out well, including bringing the original discovery into production.

Hall previously developed some Russian oil interests for Aminex before realising that he was best off to sell-out for $20m, using the dosh to draw up a whole new business plan for Aminex through an investment in Tanzania, where he discovered the off-shore Kiliwani North gas field.

He brought this into production and, more importantly, also discovered the on-shore Ruvuma PSA licence gas field in a joint venture with Tullow Oil, although the latter pulled out before Aminex hit pay dirt with its first successful drill, which flowed nearly 20 million cubic feet a day.

A second well flowed at 17 million cubic feet a day and Hall then managed to attract the interest of Mohammad Al Zubair, the founder of Omani Zubair Corporation, a conglomerate with interests in property, tourism and energy. Through one of its subsidiaries, Eclipse Investments, Zubair Corporation invested in Aminex and participated in a €12m placing, which gave it a commanding 28% stake in the Dublin- and London-listed exploration company.

Before Hall retired from the group in 2018, he set about copper-fastening Aminex’s future by signing a full farm-out deal with another Zubair subsidiary – ARA Petroleum Tanzania (APT). It acquired two-thirds of Aminex’s 75% stake in the Ruvama licence for an initial $5m cash and, more significantly, a full development and production deal that committed APT to spend $140m to further develop the field and bring it into production.

This meant that Aminex had no responsibility for the future funding of this gas field’s development. On foot of this deal, Hall exited Aminex before taking on the position of chairman at the much smaller Western Mining group, a small-scale gold-mining operation in Nevada, US.

It has taken a lot longer for APT to get up to speed but the circumstances now indicate that it is finally set to kick into action. It is unlikely that Ambrose was reappointed last month to the Aminex board, chaired by Charles Santos, without there being something cooking. Ambrose is an executive of APT and was COO of Zubair Corporation’s energy division. He boasts 40 years’ experience in the oil and gas industry and has been close to Sultan al-Ghaithi, a fellow nominee of Zubair Corporation.

More significant is APT’s decision to buy out another stakeholder in the Ruvuma licence, Scirocco Energy – a small AIM-quoted company that bought a 25% stake in the licence over a decade ago. APT has agreed to buy Scirocco’s holding in the licence and, following pretty protracted negotiations, secured both local tax clearance and local government approval for the transaction.

It seems clear that APT would not stick a senior suit on the Aminex board as a non-exec and also buy out an investor if the project wasn’t set to advance.

Over the last year ARP has conducted a 338 sq km 3D seismic survey over the Ruvuma licence to improve its understanding of the gas field already discovered as a result of the initial two discovery wells and, in particular, to better determine the optimal location for the delayed step-out CH-1 well.

Charles Santos

The Tanzanian government is also eager to bring the gas field into production and is building a 35-km pipeline to the existing Madimba gas processing facility, which can process 210 million cubic feet of gas a day. This facility is connected to a 300-km pipeline that can handle 784 million cubic feet of gas a day, all of which is required by the capital city of Dar es Salaam.

APT’s first target customer is the Dangote cement plant, which is only 50 km up the coast, but there is also a gas purchase agreement with TPDC, which was facilitated by the business-friendly president Samia Suluhu Hassen, who took over from the autocratic John Magufuli, who died in 2021.

The plan is for the first Ruvuma discovery well to be brought on stream once the adjoining pipeline is completed, with an expectation of 140 million cubic feet of gas a day by the end of the year. The field – without a third discovery well coming on stream – had been estimated by consultants RPS to have 1.87 trillion cubic feet of gas, with a possible 50% recovery. Based on recoverable reserves of one trillion cubic feet, at the last gas price struck by the TPDC of $3 per cubic feet, this would make the Ruvuma field worth a chunky $3bn.

This would be a remarkable figure given Aminex’s 25% share here and its tiny market cap, although it will be some time before the result will be tangible given that initial production from the first discovery well is only expected to flow at 140 million cubic feet a day, generating revenue of $420,000 a day, or $153m pa.

As well as bringing the first discovery well into production, ARP plans to drill a new step-out CH-1 well and, if successful, the connectivity between all three wells would massively increase the size of this gas field.

Brian Hall

PROVING UP

Aminex’s first discovery in Tanzania, in its offshore Kiliwani North discovery, produced six billion cubic feet of gas from the reservoir before it was closed in. The adjoining operator on the Songo Songo Island gas field to the west is, however, shooting 3D images in the immediate neighbourhood and has agreed to cover Aminex’s licence area at no extra cost.

The Irish company already has an estimated 57 million cubic feet of gas in a separate reservoir that has been identified on 2D images and the plan is to prove up with the 3D programme.

Because three pipelines and a processing plant are already in place, if the 3D images prove up this reservoir, it should not be overly challenging for Aminex to farm this out to the adjoining operator, PAET. It would appear unlikely that Aminex would tackle the project itself given that its operating model is to avoid taking on financial obligations, preferring to farm out prospective licences.

Aminex also has another offshore licence attached to the Nyuni acreage. This is a deep-sea opportunity and only suitable for the big boys but there have already been significant deep-sea discoveries offshore Tanzania, which followed on from the huge discovery offshore Mozambique from which Cove Energy investors made a killing a decade ago. In particular, Equinor has drilled 15 wells and discovered 20 trillion cubic feet of gas, while other companies such as Statoil, Petrobas and Obhir have discovered a further 20 trillion cubic feet. In addition, the giant Chinese state exploration company CNOOC is currently negotiating off-shore blocks, so farming-out opportunities look plentiful.

With Aminex apparently on the cusp of not just producing gas before the end of this year from one of its existing discovery wells but also drilling the step-out CH-1 – and thereby potentially significantly increasing the total size of the gas field on its Ruvuma licence – this is an exciting time for the company’s shareholders.

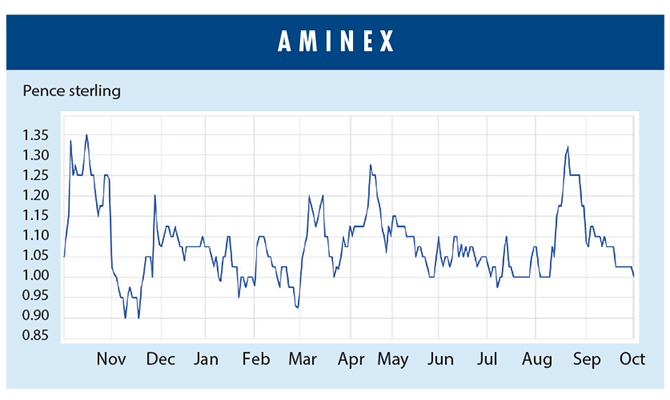

Aminex has a free carry on the full development costs, valued at $35m, which is the market cap of the quoted Irish company. It had been trading under 1p but in recent months has traded over 1p on very little volume.

Good drilling results from the CH-1 well could have a significant impact on the share price in the short term, while confirmation of any production later this year from the first discovery well will also have a positive, if not so dramatic, impact.

Indeed, the downside on the shares right now looks pretty limited.

Reference the Market Abuse Regulations 2005, nothing published by Moneybags in this section is to be taken as a recommendation, either implicit or explicit, to buy or sell any of the shares mentioned.