Keith McGrane

WITH THE 2023 figures for Corre Energy due to be released at the end of this month, investors will be looking to see if the losses have been stemmed or if there is any prospect of much-needed new investment flowing into the business. The Irish operation is an audacious bet on the renewable energy sector but the costs involved in becoming a player here remain daunting – too much so for shareholders, judging by the share price slide, which was exacerbated by a controversy not of Corre’s making.

Corre Energy was floated off by Davy at €1 a share in September 2021 to raise €12m in new equity, giving the new investors a 19% stake in the enlarged equity. This capitalised the company at the time at €64m.

Corre is operating in a really interesting area, given that energy production is increasingly set to rely on renewables, in particular on wind power and solar energy. This gives rise to the problem that these sources only produce energy when the wind blows or the sun shines and, therefore, are variable in output.

With the EU targeting 70% of electricity generation to come from renewable sources by 2030, this variability will become a critical factor and Corre’s main focus is to develop huge underground renewable energy storage facilities, which can be called upon at short notice to handle the downside variability of renewable production.

One of the founders of Corre Energy is Keith McGrane, who realised the potential in being able to develop large underground renewable energy storage facilities to store compressed air in underground salt caverns.

The energy used to compress the air is driven by surplus renewable energy production, which cannot be used off-peak and which can be acquired at very low cost. The compressed air can then be combined with green hydrogen stored in co-located caverns to generate electricity at peak times.

McGrane previously worked in national resource financing at KBC and Barclays, and directly in renewable development with Eddie O’Connor’s Airtricity, as well as with Gael Electric.

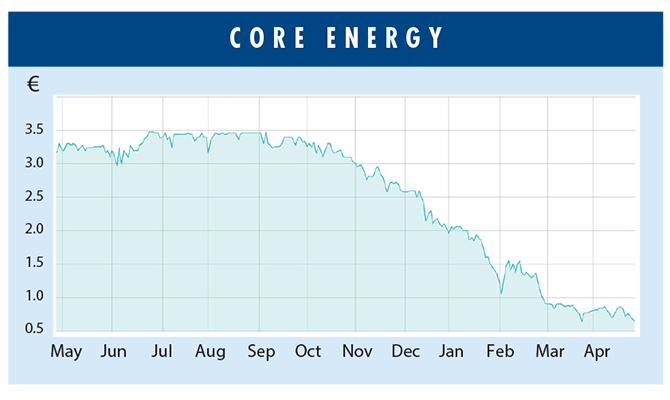

His concept caught the market’s imagination, with the shares driving up to a peak of €3.90 by February last year. Since last October, however, these have been on a dramatic downslide, plummeting back to 65c, an 83% drop from the peak and 35% off the original €1 float price.

As Moneybags previously noted (see The Phoenix 28/1/22), the challenge for Corre Energy was always that it would take around five years to get its first project under way – a very long time as far as investors are concerned.

The key problem for the company, of course, is that it cannot generate revenue in the short term from its first project, which is not due to come on stream until 2027 at the earliest. It is very difficult to manage the financial implications of this scenario, with the company turning in pre-tax losses of €7.6m in 2021 and €34m in 2022, while the half-year figures to June 2023 showed a €6.4m loss.

It should also be noted that the reported loss in 2022 includes a non-cash revaluation of share options, based on the conversion rights of the big funds. Stripping these out reduces the loss in 2022 to €11m – still significant but not as bad as it looks at first glance.

It is clear when you examine the demands on Corre Energy to get it close to its goal that the problems are becoming very challenging with, for example, legal and professional costs over the two years to the end of 2022 coming to €10m.

The company has kept afloat thanks to funds advanced from the Italian Energy Efficiency Fund II – an Italian reserved alternative investment fund – which has so far put up a chunky €42m. This fund has the option to convert these loans into shares at €1 each at any point up to June 2028. If converted, it means existing shareholders will be seriously diluted.

It has obviously not helped that founding director, president and 38% shareholder Darren Patrick-Green has had to resign as a result of a tax investigation into one of his companies (not linked to Corre). The problem was that a Singapore entity ultimately owned by him was named by His Majesty’s Customs & Excise as being involved in an alleged tax avoidance scheme. The bad news, which knocked 35% off the share price at the end of February, was not overshadowed by the appointment last month of Rothschild & Co to advise Corre Energy on approaches from various parties regarding possible investment in the company.

Corre specialises in long-duration energy storage (LDES) projects. While the initial focus of the company was in continental Europe – particularly the Netherlands, Germany and Denmark – the passing of Joe Biden’s Inflation Reduction Act in the US has led the Corre Energy board to look to participate in LDES opportunities across the Atlantic. An important player here is Corre chairman Frank Allen, an ex-KBC bank executive and Iarnród Éireann board member, who is also an advisor on World Bank infrastructure projects.

TAX CREDITS

Biden’s legislation, which was passed in August 2022, offers companies such as Corre Energy investment tax credits of 30%-40% of capital costs for standalone energy storage projects, as well as green hydrogen production tax credits of $3 per kilowatt provided.

The first project Corre Energy pushed is a big worked-out gas cavern outside Zuidwending in the Netherlands. This appears to have the required characteristics for holding pressurised air, with the aim being to store compressed air with a generating capacity of 320 megawatts (MW) that, when loaded, will have a daily output capacity of up to 4 gigawatt hours.

This project has been developed in partnership with Infracapital (part of the M&G investment group) and will be financed on an equity share basis, with an initial €2m development fund and a further €6m when title to the cavern has been secured.

Frank Allen

PROJECTS

A problem that arises for Corre is at what is called financial close, which is the point at which the project is built out. Corre Energy will then have to put up €9m and there could be a problem with this given that €4.7m of the €9m is to come from a loan guaranteed by Green.

This, however, is pretty small beer given that it will cost an estimated €267m to bring this particular cavern into play, while the project will take years to complete.

Corre’s first Dutch project, ZW1, has made some progress and a 15-year offtake agreement has been signed with partner Eneco, a major Dutch energy company.

It is a notable achievement for such a project to secure a long-term offtake agreement.

So far, Corre Energy has completed the front-end engineering design for ZW1 and good progress has been made on obtaining permits for the project.

In Denmark, Corre is working on a 320 MW integrated green hydrogen storage project. This has been developed with a local renewable company, Eurowind Energy, and with the Danish state-owned grid operator, Energinet. Corre CEO McGrane has reported that the front-end engineering design work carried out here has gone well, while progress has also been made in securing offtake agreements.

McGrane also reports progress and negotiated agreements for new sites in Germany and he is moving to secure rights to several caverns with a range of potential joint venture partners, as well as negotiations on offtake agreements. Meanwhile, further salt caverns have been identified across Denmark, the Netherlands and Germany.

While there is huge potential for underground storage projects, this is an area that clearly involves huge capital investment, as well as securing long-term offtake agreements and long-term agreements to allow the company use the surplus energy generated, for example, to pressurise gas in these caverns. For a company as small as Corre Energy, these are very significant issues and the share price collapse may be reflecting this challenge in particular.

It is quite the ask for ordinary stock market investors to be patient enough to sit back and wait for five years before seeing any return, even if that potential return may be substantial.

While Rothschild & Co is currently viewing approaches that have been made to Corre by potential investors, with a view to seeing how these can be tapped to fund some of the projects, it is far from clear what sort of approaches have been made.

Corre, however, does have its Dutch and German salt cavern projects signed up, as well as having options over four other caverns in Germany. In west Texas too, McGrane et al have identified salt caverns with 280 MW compressed air storage capacity.

All this will require hundreds of millions of euro investment and it is surely only if a giant utility outfit wanted to take Corre Energy out that it is possible to see the projects come to fruition. Such a purchaser could well pay a multiple of the current share price, which is probably what is keeping investors interested at this stage.

Reference the Market Abuse Regulations 2005, nothing published by Moneybags in this section is to be taken as a recommendation, either implicit or explicit, to buy or sell any of the shares mentioned.