Eamon O'Brien

IMC EXPLORATION is a tiny little Irish company that, although quoted on the London AIM stock exchange, remains very much under the radar in Ireland. This is despite the fact that the outfit owns the licences and mining rights around the old Avoca copper mine and is on the cusp of a most intriguing deal concerning a goldmine in Armenia that will double IMC’s market capitalisation.

The Avoca copper mine was actually included in a 150 AD map of Ireland by Greek geographer Ptolemy when it was known as Apoka. It was operated by the state as recently as 1982.

IMC is now headed up by Irishman Eamon O’Brien, who started off on Wall Street before returning to Ireland to work for Dermot Desmond at NCB stockbrokers. He then moved to Davy before taking charge at IMC and he has now unveiled a rather dramatic proposal to turn this company into a much larger entity by reversing into a Czech-controlled gold project in far off Armenia. The audacious deal is dependent on getting the approval of IMC’s shareholders at the EGM on October 26 in the Aisling Hotel, D8.

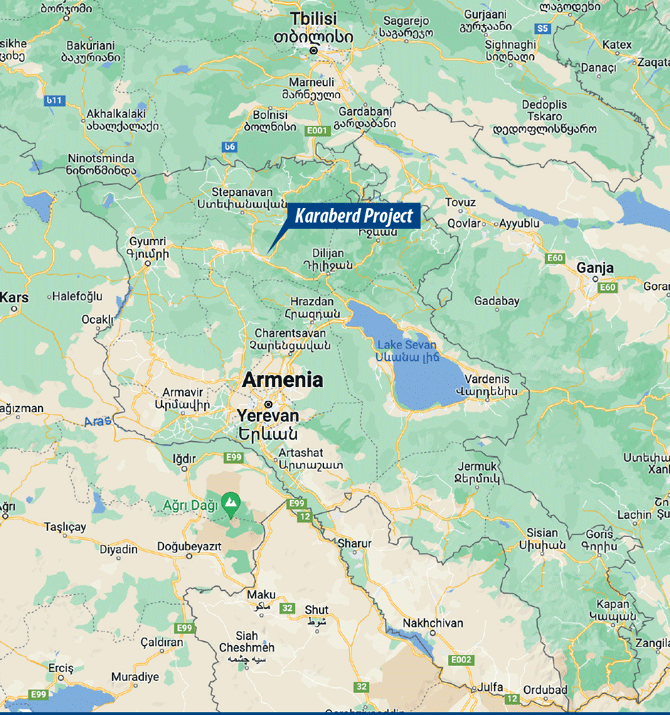

This is a daring strategy by IMC Exploration given the hostilities that exist between Armenia and neighbouring Azerbaijan and the dispute that has been ongoing for centuries over the Nagorno-Karabakh region, which is claimed by Azerbaijan but mainly populated by Armenians. A recent peace treaty gives Azerbaijan control over the region and has resulted in tens of thousands of Armenians fleeing the territory.

The Czech group that is central to IMC’s reverse takeover has been involved in gold mining in Armenia for over a decade. In 2013 it identified the Karaberd mine, where it mined 2,000 tonnes of ore over three years to 2017 but not on a sufficiently commercial basis.

In 2021 the Czech company, Assat, resumed operations and last year extracted over 10,000 tonnes of gold ore, which has been stockpiled for subsequent extraction when it has built its planned new metals extraction facility.

It is clearly unusual that a tiny Dublin-headquartered exploration company would end up involved dealing with a Czech group and its Armenian mining operation but the key factor is that the Czechs have taken a fancy to the Avoca mining prospects that IMC controls and is prepared to participate in the funding of the exploitation, initially, of the Avoca tailings and spoils.

The plan is to then go on to explore the licences for further copper in Avoca and gold in north Wexford, providing €20,000 per month to IMC for working capital and also giving IMC a funding line of €1.5m to be drawn down by way of preference shares.

In relation to the Karaberd goldmine in Armenia, the Czech special-purpose vehicle that owns the Armenia mining rights is Mineral Ventures Invest (MVI). This entity owns Assat LLC, the company that holds the operating licence for the goldmine.

Assat has, in turn, a contract with the China National Geological and Mining Corporation to build a gold processing plant, with completion scheduled for September 2024 at a cost of €4.6m, of which it has already paid a €650,000 advance. The Czech company will be providing the funding to pay for this mining plant, which will then be leased to the Assat operation within the enlarged IMC group.

The processing plant will be handling ore body from other mines in Armenia but is designed to handle the extracted ore already stocked pile as well as production over the next 11 years. Based on management forecasts to 2033, consultants Alvarez & Marsal has advised that the mine’s production has a net present equity value of £42m.

Despite the political tensions, the overall risk for IMC Exploration is not as high as might be expected. All of the mining finance will be provided by the parent company of MVI, with the plant being leased to the IMC operating company Assat, so the downside appears relatively low in comparison with the clearly significant potential upside.

In relation to IMC, it controls the old Avoca copper mine and the two million tonnes of spoils and tailings that currently sit there. In the past, the ability to extract metals from ore body was very crude but, since the technology has advanced so much, today the spoils and tailings can have real value.

In the case of the two million tonnes sitting in Avoca, it is estimated that they contain gold, silver and copper worth $80m, boosted by the current copper price of €8,400 a tonne –10 times the price when the mine closed down in 1982.

IMC hopes to extend its interests to the Karaberd mine in Armenia

IMC carried out the JORC Code-compliant mineral resource estimation report on the spoil heaps at Avoca, which shows that it contains 1.87 million tonnes of pre-crushed rock grades of gold of 0.3 grammes per tonne, silver of 8 grammes per tonne and grades of copper of 0.14%.

These are contained in the spoil heaps on the eastern half of the site and equate to 20,000 ounces of gold, 600,000 ounces of silver and 2.6 tonnes of copper. (There are also the remains of seven engine houses left over from the old mining operation as well as a mineral tramway arch beside the spoil heaps around the old mine workings.)

It is difficult to know who exactly is behind IMC, as its current largest shareholders are hidden in Crest Nominees, which holds a 23% stake. Davy Crest Nominees holds a further 11%, followed by KBC with 8%, ITI Capital with 7% and Pershing Security (a Goodbody holding company) with 6.5%.

Liza McDonald is the largest named personal shareholder, with a 5.4% stake, while executive chairman Eamon O’Brien is sitting on a 4.4% stake. His sister, Claire O’Brien Hees, and brother, Liam O’Brien, together have a further 4% stake.

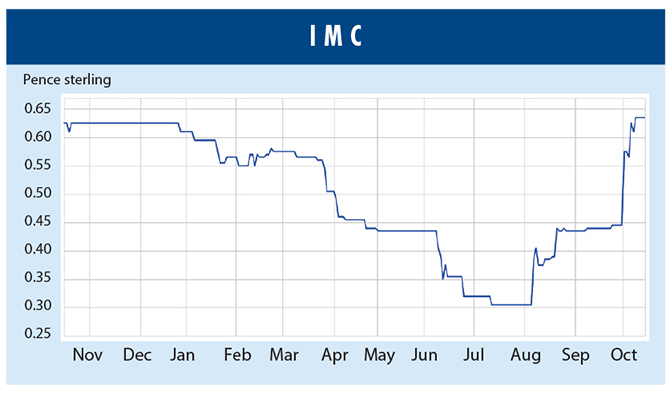

IMC Exploration’s shares have been trading on the London market for three years, starting off at 1p and reaching a peak of 2p before drifting to a low of 0.3p in July this year. They have since doubled to currently trade at 0.6p, at which price the company is valued at just on €2m.

With the share capital to be doubled as a result of the Armenian acquisition, this will make IMC worth £4m. It is clearly a small entity but also intriguing. Certainly, it will be quite the feat to return the old copper mines in Avoca to production.

There is clearly copper in the ground in Avoca and the current price of copper, at $8,400 a tonne, would make it mineable.

The records also show that 10,000 ounces of gold were extracted in the late-19th century from the east and west Goldmines River area.

IMC’s north Wexford licences at Boley hold some interest too. The company’s interests in Avoca and north Wexford are supported by the Trinity Research Lab, as well as Prof Garth Earls, who has carried out some advisory work for IMC.

Eamon O’Brien has certainly given investors an intriguing prospect to examine.

He is joined on the board by Andrew Laz Fleming, who has 40 years of experience in various sectors of the minerals and mining industry, including a stint at Ovoca Resources. He has been in situ at IMC Exploration since day one, when the players included stalwarts such as Liam McGrattan and Nial Ring, as well as managing director Glenn Millar, who has just exited the board.

Another IMC director is PR exec Kathryn Byrne of Limelight Communications, who was brought on board by O’Brien. The bio on IMC’s website notes Byrne’s appointment by the government to the An Bord Altranais board and her council membership of Gaisce – the President’s Award. There is no room, however, for any reference to her former vice-presidency of Fianna Fáil.

Reference the Market Abuse Regulations 2005, nothing published by Moneybags in this section is to be taken as a recommendation, either implicit or explicit, to buy or sell any of the shares mentioned.