Michael Carvill

TWO YEARS ago, Mick Carvill was facing oblivion in Kenmare Resources having lost $200m over the preceding 24 months and leaving the company in breach of all the group’s banking covenants. Only a miracle could save Kenmare, it appeared, and something close to this arrived in the form of the Gulf state of Oman sovereign fund coming on board to head up a $275m rescue package to keep the company mining.

Although the original Irish Kenmare shareholders have been almost totally wiped out, the good news is that the company is now nearly debt free and last year turned in an ebitda surplus of $60m. With an 8% share of the world’s ilmenite and titanium dioxide market, Kenmare is a clean play for a big global mining financing house.

It is surely only a matter of time before it will be taken out at a significantly higher value than the €300m at which it is currently capitalised, particularly given that it has 100 years of reserves. This has the characteristics of the almost perfect business model for the likes of RTZ or Anglo American.

Last year Kenmare dug out 20 million tonnes of ore to produce just on one million tonnes of ilmenite, the concentrate from which titanium dioxide is produced, as well as the 74,000 tonnes of zircon, a much more valuable concentrate now trading at $1,000 a tonne as against $600 just two years ago.

Ilmenite is, however, the more significant concentrate for Kenmare and it has seen prices increase steadily from $100 a tonne two years ago to $150 a tonne today.

rising revenue

The total impact of somewhat higher production but significantly higher prices has pushed Kenmare’s sales revenues up by a very significant 47% from $142m in 2016 to $208m last year.

The key problem encountered by Kenmare was that 10 years ago ilmenite was selling for $300 a tonne and Mick Carvill thought he could simply not fail given that operating production costs were running at $200 a tonne.

At the bottom of the crash in 2010, however, Carvill made the extraordinary decision to increase Kenmare’s production by 50%, taking its world market share up from 6% to a very high 9% at a cost of $270m. Carvill could hardly have got it more wrong as pushing out more production into a declining market was a recipe for disaster, particularly with Kenmare itself one of the causes of over-supply.

The price of ilmenite fell from $300 a tonne in 2008 to a 30-year low of $127 a tonne at the beginning of 2016 – a major setback for the company.

Despite a series of highly diluting fund-raising exercises – of $270m in 2010, $67m in 2012 and $90m in 2013, a total of well over $400m – Kenmare ended up in real trouble with bank borrowings rising to a net $375m in 2016.

Many executives would have considered the situation hopeless but Mick Carvill had a plan based on the fact that down at these low prices every mine in the world was losing big bucks.

With most other operations running at much higher production costs, many of them would go bankrupt or mothball their operations. On this basis Carvill talked the Sultan of Oman into backing Kenmare as a $100m keystone investor in a $275m rescue package.

Surprisingly, Prudential Insurance company participated in the fundraiser even though it had already lost $150m in Kenmare, putting up an additional $70m.

Other backers were the Dutch Majedie asset fund that put up $30m, the American Capital group ($30m), Eurobank ($30m) and the Mauritian sovereign fund ($15m). This exercise caused a near 99% equity dilution for existing shareholders but Carvill saw it as the best option when compared with walking away from the whole project.

major plan

Sultan of Oman

At the same time Carvill set about implementing a major programme to reduce costs from $200 a tonne by increasing productivity all around and making savings where possible, including reducing staff by 162.

This cut production cost per tonne from $200 a tonne to $136 by 2016 and an even lower $132 a tonne last year.

With the banks no longer pressurising Kenmare and much higher commodity prices pushing revenue up 47% last year to $208m, the group’s ebitda rose from $5m in 2016 to $60m last year. In the process net debt fell by a further $11m to a very modest $34m by December 2017 – over 90% less than the debt mountain that existed two years ago and almost irrelevant in the context of a $60m ebitda surplus.

In the rescue package two years ago, Carvill managed to get the banks to take a $69m hit as part of the $275m equity raised and as long as he maintains control over production costs Kenmare is looking at a clear path ahead, with commodity prices continuing to drift upwards.

As long as Carvill keeps focused and maintains production at the current levels, while continuing to contain or reduce operating costs Kenmare is set to benefit significantly from rising commodity prices over the next few years.

Bearing in mind that there is a lag in the price Kenmare gets, as it has to contract ahead of production, at current prices (assuming flat production) the company should manage to nearly hit sales of $250m in the current year.

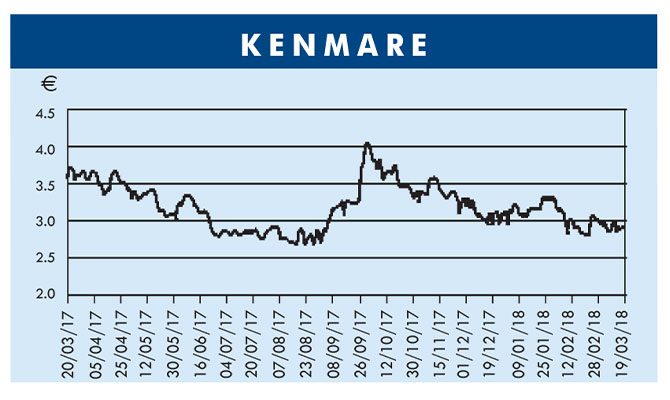

This increased revenue would drop straight to the bottom line and increase Kenmare’s ebitda to $100m, making its current share price of €2.85 look very low. Investors could be looking at a company capitalised at €300m while producing $100m ebitda and the little debt it has now set to be wiped out by the end of this year.

With its significant institutional shareholder base, Kenmare resources is almost perfectly set up to be taken out by one of the big boys, who could easily pay twice the current share price.

In the meantime, the situation is only getting better and while this company has cost investors hundreds of millions and has certainly wiped out Charlie and Mick Carvill’s already tiny shareholding in the group, those investors still hanging in there will be holding out for a big payday.

Reference the Market Abuse Regulations 2005, nothing published by Moneybags in this section is to be taken as a recommendation, either implicit or explicit, to buy or sell any of the shares mentioned.