Dalton Philips

NO DOUBT there were high hopes in Greencore that the new CEO, Dalton Philips, would be able to revolutionise the company. It certainly hasn’t worked out that way and the latest figures are far from reassuring. Moreover, it is hard to see where Philips even wants to take the UK sandwich giant.

Philips was appointed boss in spring 2022, before his starring role in the Dublin Airport debacle when the north Dublin facility proved woefully incapable of dealing with the numbers of post-pandemic passengers hungry for international travel.

The DAA chief executive had overseen the redundancy of around half of the airport’s staff at a cost of €100m, when the smart move would have been to temporarily lay off workers until the numbers began to creep up in 2021. The result was total chaos at Dublin Airport on May 28, 2022, when the operation had to be effectively shut down, with 10,000 would-be passengers stranded outside.

Matters were not helped by the revelation that Dalton Philips had used the special executive lounge that day to fly to Dubai. This service allows minted passengers to avoid security queues and delivers its customers by car to the aircraft.

Whether he would have still landed the Greencore job post-debacle if that gig had not been already nailed down is impossible to judge. Philips was appointed by chairman Gary Kennedy, ex-AIB finance director and chairman of Goodbody stockbrokers.

The timing of Philips’s appointment did give the new man a six-month lead-in time before he actually took up the role of Greencore CEO in September 2022. Nevertheless, he has failed to shine there since.

Dalton Philips was thus in situ for the whole of Greencore’s last fiscal year, which ran to the end September 2023. On the surface, his report for those 12 months looks reasonable, with sales up 10% to £1.9bn and operating profit up 6% to £76m.

Trading margins, however, did fall 20 basis points to 4%.

Disappointingly, the new CEO did not bother to compare last year’s results with Greencore’s last normal pre-Covid trading year to September 2019. For the record, in the 12 months to September 2019 the group actually recorded lower sales of £1.45bn so, on that front at least, Philips has not done badly at all. Revenue, however, is rarely a reliable indicator of performance.

At the far more significant bottom line, the 2023 figures are desperately disappointing, with last year’s £76m operating profit comparing poorly with the £106m turned in in 2019.

As a consequence, the trading margin collapsed from 7.3% to 4%, while pre-tax profits were down 37% from £92m to £58m. Moreover, at the crucial earnings-per-share level, earnings almost halved from 16p in 2019 to 9.3p last year. This is simply a dreadful result.

Dalton Philips does boast an impressive-looking track record, having worked for the Jardine Matheson conglomerate, the giant American Walmart group, the dominant Canadian Lablow supermarket chain, Brown Thomas, Boston Consultancy and, before joining DAA, the William Morrison supermarket group, the fourth largest in the UK.

In its last full year under Philips, to January 2015, Morrison’s profits just on halved to £440m, forcing the group into an impairment provision of £1.3bn and a pre-tax loss of just on £800m. The then chairman of Morrison advised shareholders that the situation “required a change in leadership”.

(Philips’s successor as CEO, David Potts, took over in March 2015 and said he would “set about injecting new pace into the turnaround” and, remarkably, identified £1bn of savings to be made by restructuring its head office and rationalising the group’s retail chain. Potts’s record in recent years, however, has not impressed.)

After Kennedy announced Philips as the new Greencore boss, he noted: “There are many things about Dalton that impress me. He has a strong track record of leading dynamic consumer-related businesses and he has an outstanding knowledge of the grocery sector. He is an excellent leader, very effective communicator and has a great awareness of all stakeholder interests”. (Last year, however, Kennedy resigned as chairman, a month before his death at the age of 65 after a short illness. He was replaced as Greencore chair by Leslie Van de Walle.)

During his five-year stint in Dublin Airport, Philips made several structural changes, in particular “consolidating” food and beverage concessions into larger tender packages “in order to be more proactive in the strategic management of this important element of passenger experience”.

In 2020, he completely reversed the policy that had been adopted by DAA to avoid the airport having a dominant food and beverage operator, which had been the case in the late 2000s. Nevertheless, he gave SSP 24 additional food and beverage outlets, both airside and landside in the airport, to give it a dominant position. Coincidentally, after Paddy Coveney jumped ship from Greencore in 2022, he became CEO of SSP.

NEW ROLE

Other Dalton Philips legacies at DAA include the building of a second €500m runway (as part of a costly €2bn development plan), the budget for which did not include the €200m cost of building a tunnel underneath the new runway. Given the 32 million passenger cap imposed by Fingal County Council, the whole expensive expansion project looks impossible to justify in the absence of assurances that the cap would be lifted.

When taking on his new role in Greencore, Philips said: “I already knew about the fantastic work that Gary Kennedy, Emma Hynes and Kevin Moore were doing in leading the business

since Paddy Coveney stepped down in March but what I was less aware of was the strength and depth of the team at absolutely every level of the company.”

Despite the plámás, however, none of these execs are still with the group, with Philips having appointed Lee Finney as COO just one month into his reign.

Greencore remains one of the biggest sandwich manufacturers in the world, producing 779 million sandwiches last year, as well as 132 million chilled ready meals and 45 million chilled soups. The giant operation only operates in the UK market, however.

Leslie van de Walle

STRATEGY

In the 2023 annual report, Dalton Philips says of Greencore’s strategy: “We are one of the UK’s leading convenience food producers. We have built this position through long-term partnerships with major UK retailers in attractive product categories.” This is hardly a statement of strategy.

He continues: “Our strategy is focused on accelerating financial return and delivering growth.” Again this is not a strategy but rather a description of normal trading.

Strategy relates to having a vision for the future with plans of up to 25 years but Philips, despite his Harvard MBA, does not appear to understand what strategy is or maybe has decided that it is most beneficial to simply let the company drift along on its current path.

At least former CEO Coveney had a strategy to turn Greencore into “the leading international manufacturer of convenience food” and went about implementing his strategy with the $750m takeover of Peacock Foods in the US. But this ended up looking more like an attempt to make sense of the $100m the group had already spent building up operations across the Atlantic, where it boasted sales of £223m in 2016 but losses of £2m pa.

Even with the Peacock acquisition, Greencore achieved US sales in 2016 of only $881m and trading profits of $33m, representing trading margins of 3.7% – only half that achieved at the time in the UK.

Selling out of the US only two years after buying Peacock just about got the group out intact but, having already sold off its leading convenience food business in Belgium and its huge European malting business, Coveney left Greencore a pale shadow of its former self, trading only in the UK.

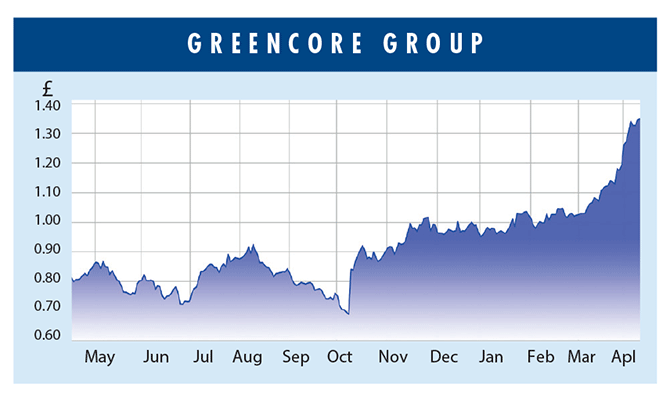

On the basis that Coveney knew what he was doing when invading the US market, investors pushed Greencore’s shares (now quoted only in London) up to just on £3 in 2016. They fell to a low of 60p in December 2022 but have since recovered to £1.32, at which price they are trading on a price/earnings multiple of 14.4.

The update on the first quarter of 2024 has not given shareholders much to get excited about, with pro forma revenue not even flat when compared to the first quarter of the previous fiscal year. For those investors who rate Philips and believe he will get Greencore generating the margins it was delivering in 2019, this would require almost doubling current trading profits to £140m. That scenario would put the shares on a prospective p/e of 8 and almost certainly drive the share price up significantly.

For those with less faith in Philips and who expect him to simply muddle along without any discernible stated strategy, the shares will not be going anywhere any time soon.

Reference the Market Abuse Regulations 2005, nothing published by Moneybags in this section is to be taken as a recommendation, either implicit or explicit, to buy or sell any of the shares mentioned.