Dalton Philips

HAVING DISAPPOINTED the unfortunate Greencore shareholders over his 13-year reign, Paddy Coveney parachuted out of Greencore and left behind a company that is a shadow of what it once was. If investors were looking for some relief under a new regime, it is unlikely that they were overly optimistic about Coveney’s successor, Dalton Philips. The absolute chaos at Dublin Airport unfolded under his watch around the time of his announced move to Greencore – hardly auspicious timing. Dalton’s previous stint at the Wm Morrison supermarket group was also rather less-than stellar but the good news is that the bar is now so low at Greencore the only way is up.

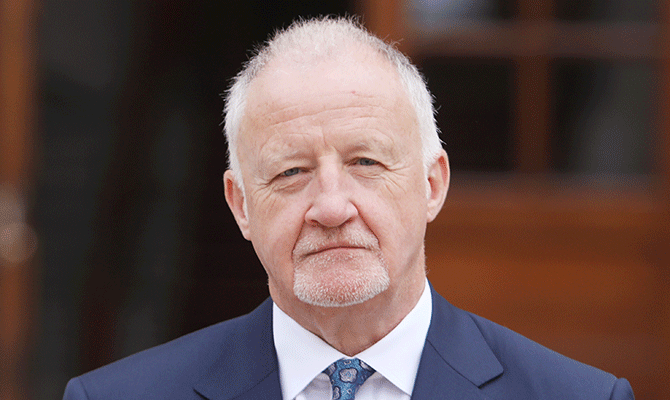

While the new CEO boasts a CV that will ensure the jury remains out on Philips, what must be a concern for Greencore shareholders is that the board reign of outgoing chairman Gary Kennedy almost completely overlapped with the whole of Coveney’s very well-remunerated stint.

The latter’s strategic disasters included the failure to offload the group’s 1,000-acre land bank that was created by the closing down of sugar factories in Middleton and Carlow in particular, as well as the Minch Norton operation, along with smaller closures in the UK.

At the top of the market, the sites were worth around €1bn, with Liam Carroll notably interested to the extent of buying a 22% stake in Greencore in 2006.

Coveney, however, opted to hang tight and Greencore ended up with its residual land bank today valued on its balance sheet at €3m.

While that might be the single costliest decision Coveney made, the spending of €1bn to build a big US business, notably through the $750m takeover of the American Peacock Foods group, failed to deliver on Greencore’s stated ambition to be “the leading international manufacturer of convenience food”. Instead, the CEO carried out a complete retreat from the US in 2018, with the company just about surviving the experience.

It is surprising that Coveney himself survived that most unfortunate chapter but Kennedy can empathise with being the wrong man in the wrong place, having been finance director of AIB from 1997 to his timely exit at the end of 2005. During this period, he led the bank’s massive lending splurge that contributed to AIB eventually needing €21bn of state funds to stay afloat.

At Greencore, David Dilger had built up a huge business and impressively took out Hazelwood Foods back in 2006 in a €500m acquisition that became the base for Greencore’s subsequent development. He had also built up its malting business and bought the UK’s largest malting company, Pauls Malt, to merge with Minch Norton.

This turned Greencore into the fifth-biggest maltster in the world but Coveney duly dumped the operation to focus on becoming “the leading international manufacturer of convenience food”.

Selling off Greencore’s big frozen pizza business as well as its bakery division also made little obvious sense at the time, but exiting from the position of being the leading convenience food sandwich maker in Belgium was probably the hardest Coveney move to comprehend.

Despite the unimpressive track record, Kennedy noted it was “a privilege to work with so many talented colleagues at Greencore for more than 14 years as we transformed the group into a leader in the UK convenience food sector”.

Given that Greencore had also been a leading Belgian and US convenience food operator, it is hard to associate the word “privilege” with the process of ending up with a group that is significantly smaller than its recent incarnation.

Moreover, most of the board bailed out last year, including Gordon Hardie, Helen Weir, Paul Drechsler and company secretary Jolene Gacquin.

Kennedy was happy to boast that the group had achieved “a diverse board with 60% female representation”. Presumably, today’s board is also a high-quality one.

NEW CHAIRMAN

Not surprisingly, Kennedy had plenty of nice things to say about his new CEO, who arrived on September 26 last year. According to the chairman: “There are many things about Dalton that impress me. He has a strong track record of leading dynamic consumer-related businesses and he has an outstanding knowledge of the grocery sector.

“He is an excellent leader, very effective communicator and has a great awareness of all stakeholder interests.”

Despite the glowing reference for the CEO he brought in, Kennedy himself has decided to retire – not just as chairman but from the board completely – with an outsider, Leslie Van de Walle, to be installed as chairman this week.

The latter has no experience of Greencore, although he has considerable experience and exposure to good companies such as Danone, Cadbury, Schweppes and United Biscuits.

That said, he was in situ as a senior suit at Cadbury Schweppes when Fever Tree blew the bloody doors off.

Van de Walle’s only obvious Irish connection was a non-exec director gig at DCC up to 2020, which is not too relevant for a convenience food company.

Coveney is now heading up SSP, which is mainly involved in catering in airports. Coincidentally, SSP became the biggest caterer at Dublin Airport when Philips was calling the shots and it now has a 70% market share in all the food and beverage operations there.

Philips saw it as a major achievement by him that Dublin Airport “consolidated its food and beverage concessions into larger tender packages in order to be more proactive in the strategic management of this important element of passenger experience”.

In 2020, he contracted SSP to run 24 separate food and beverage outlets, both airside and landside in the airport, on top of the outlets it already had. Given the near monopoly position SSP has attained, it is hard to see this strategy as a good one for DAA, which operates the Dublin Airport.

As DAA boss, Philips came up with a huge and hard-to-justify €2bn investment plan for the airport, sparring with the Commission for Aviation Regulation when looking to convince it to agree to increased passenger charges. In reality, Philips should have only invested in projects that made Dublin Airport more efficient, allowing it to reduce its airport charges for airlines to make Irish tourism more competitive.

While the building of the second major runway at Dublin (which opened in August last year) was a good idea, spending €320m on the project is simply impossible to justify. Even using Irish contractors, it would cost approximately €10m to build one mile of a six-lane motorway. Given that the end result would have to be reinforced to a far greater degree than an ordinary motorway, a figure of €100m would surely cover it. How could it cost three times this?

Gary Kennedy

BACKGROUND

On top of this spending spree, Philips floated the idea that DAA should spend another €200m building an underpass under one of the runways. Its key purpose is to enable airport vehicles to shuttle between Terminal 1 and new aircraft stands that are planned at the airport, but it is unclear if the hefty spend is necessary.

Ryanair has dismissed the project as “a waste of money”.

Prior to joining DAA, Philips spent five years running the fourth-biggest UK supermarket group, Morrisons, up to March 2015. In his last full year to January 2015, profits just on halved to £440m but the underlying deterioration was such that the group had to take a £1.27bn impairment provision, pushing the company into a pre-tax loss of a huge £792m.

The chairman who came on board in January 2015, Andy Higginson, led the board to the conclusion that the situation “required a change in leadership to see the business through the next three-to-five-year period”.

He did advise that Philips “brought great personal qualities and values to his leadership of the business, having had to manage against a backdrop of considerable industry turmoil and change. We thank him for his contribution.”

CHOICE OF CEO

David Potts took over as CEO at Morrisons in March 2015 and, according to Higginson, the new man “set about injecting new pace into the turnaround”. Remarkably, Potts identified £1bn of savings to be made in his first two years, beginning with a restructuring of its head office, before closing underperforming stores and selling off the M chain of small local groceries.

The new CEO led the group back to a pre-tax profit of £217m in his first year at the wheel.

Given the performance at Morrisons and Philips’s subsequent move to a state job running an effective airport monopoly in Ireland, it is hard to make sense of Kennedy’s choice of the DAA boss as Greencore’s new CEO. For Kennedy to then stand down from the Greencore board (he was due to exit at the recent AGM) is doubly confusing as, if this was his plan, he should surely have let the new chairman chose the CEO rather than ‘impose’ one on Leslie Van de Walle. Appointing the CEO is, of course, the single most important function of a chairman.

Although Philips joined as CEO on September 26 last year, four days before the end of the financial year, he thought it was appropriate to issue a CEO’s report on the year, claiming that he “already knew about the fantastic work that Gary Kennedy, Emma Hynes and Kevin Moore were doing in leading the business since Paddy Coveney stepped down in March but what I was less aware of was the strength and depth of the teams at absolutely every level of the company”.

Although these sentiments were published in the 2022 annual report, Philips had already brought in a new chief operating officer, Lee Finney.

Greencore enjoyed a 29% increase in turnover to £1.7bn in the year to September 30 last, which is actually 19% ahead of the pre-pandemic 2019 sales figures. The group’s operating profit, however, while nearly doubling from 2021 to £72m, was 30% below the £105m turned in during 2019, while margins imploded from a respectable 7.2% in 2019 to 3.9% last year.

Given the big increase in turnover, this hefty reduction in profitability is worrying. There clearly is something wrong with Greencore’s tiny remaining business.

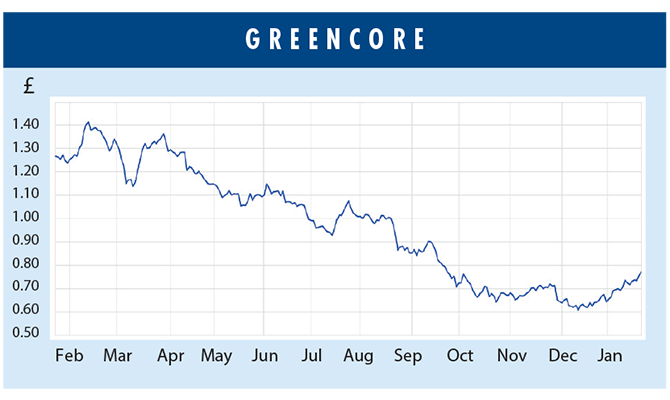

SHARE PRICE

Shareholders who bought into Coveney’s “leading international manufacturer of convenience foods” strategy – as evidenced by the big $750m Peacock Foods acquisition in the US in 2016 – pushed the shares all the way up to £3 (the company is now quoted only in London) in spring that year. Coveney even moved across the Atlantic to oversee progress and the story of just what went so wrong has yet to be written.

The embarrassing retreat just two years later was traumatic for all concerned, with the shares currently trading down at 76p – a 75% fall off – and it is difficult to know if the disaster-prone Philips will be able to reverse this trend any time soon.

Indeed, the shares are down 35% since the announcement last May of Philips as the new CEO.

Chief commercial officer Kevin Moore, who stepped up to take on the role of deputy CEO when Coveney exited, had a plan to achieve £30m of savings over the next two years. He was, however, replaced within a month of the new CEO’s arrival and presumably Moore and his team are less than happy with this state of affairs.

It could be that Philips brings his big spending semi-state company ethos to Greencore, which would be disastrous for the company, but he may also yet surprise the market.

On the basis of simply maintaining last year’s earnings, at the miserable share price of 75p, the company is trading on modest prospective price/earning ratio of around eight. Given the market’s low expectations after the mess Philips left behind in Wm Morrison almost eight years ago, it will take very little for the group to impress.

For investors who are already in, there would be little upside to selling out now given that the rating is so low it can hardly go lower… unless Philips really screws up.

Reference the Market Abuse Regulations 2005, nothing published by Moneybags in this section is to be taken as a recommendation, either implicit or explicit, to buy or sell any of the shares mentioned.