Aidan Brogan

AIDAN BROGAN, the CEO of Datalex, is in real trouble, but fans of The Phoenix may not be too shocked. Moneybags has previously questioned the firm’s accounting procedures and identified that the market was already seriously overvaluing Datalex (see The Phoenix, 26/1/18). The worry for shareholders now is what PwC will turn up in their review.

As recently as November 23 last, Brogan issued a trading update advising the market, “We are confident that we will deliver double-digit growth in adjusted ebitda for 2018”.

Last year, the company reported an operating profit of $7m and Davy was expecting ebitda for this year of $16m. The profit warning on January 15 noted that Datalex “now expects to report an adjusted ebitda loss in the range of $4m to $1m” and that the “adjusted ebitda and profit for the half-year to the end of June 2018 may have been misstated”.

This is simply cataclysmic and follows the surprise announcement on September 26 last year of David Kennedy’s intention to resign as chief financial officer, effective December 5, 2018, after 12 years of service.

Brogan’s position has not been helped by his own comment that the profit warning “is extremely disappointing for me personally”. You bet.

Serious concerns about Datalex’s accounting procedures in relation to capitalising so-called development work were highlighted in these pages back in 2017 (see The Phoenix, 21/4/17). At that time, Moneybags noted that “major question marks hang over [Datalex’s] accounting tactics, which have significantly added to what looks like an overvaluation of the shares”.

There could be a double-whammy for investors as the Datalex board is only identifying the accounting problem as one of revenue recognition and not of the treatment of research and development (R&D) spending.

The board clearly recognises that Datalex’s accounting may not be the most rigorous and the implication is that auditors EY may have been too lenient in assessing not just how the company recognises revenue but in relation to its whole R&D accounting practices. Moreover, given that Datalex is chaired by a retired but well-respected auditor, Paschal Taggart, who is also the company’s fifth-largest shareholder (3%), it has wisely asked another “leading accountancy firm” (PwC) to undertake an independent review.

It is inevitable that such a review will take a far more rigorous approach to Datalex’s accounts and the picture that emerges could be devastating. If so, Brogan will surely have to parachute out.

One player who adopted a lucrative strategy in Datalex is Nick Furlong. His Pageant Holdings family investment vehicle started investing in Datalex in 2011 when, as Moneybags noted, the company was “seriously undervalued” (see The Phoenix, 22/4/11). By March 2017, Furlong had built up the second-largest holding in Datalex, with Pageant holding nine million shares, representing a 12% stake. By this stage, the shares had risen approximately 15-fold.

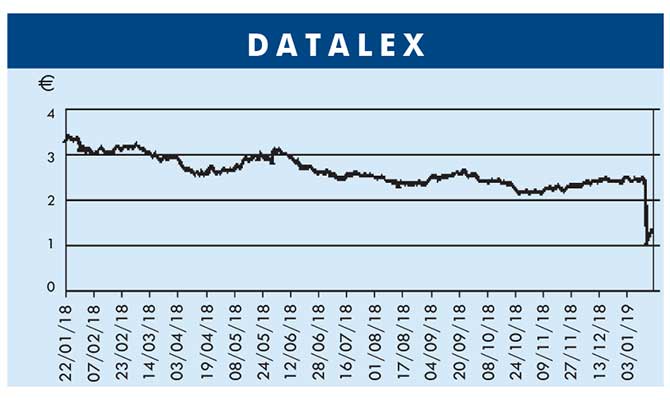

At that time, Moneybags referred to Datalex’s “frothy rating”, with the shares at €3.75. They continued to increase altitude, however, hitting a peak of €4.15 in June 2017. Between April 2017 and June 2017, the wily Furlong flogged off his whole 12% shareholding to realise the best part of €36m.

On the other side of this equation, there must also be some very sore heads. The American Capital Funds group decided to plough into Datalex for the first time in 2017 and is now sitting on six million shares (8%), making it the second-largest shareholder behind Dermot Desmond (27%).

IMPLOSION

Even more upset is Ed Makin at the American Highclere Investments group. He identified Datalex as right for his fund and only started investing in the company in 2017, topping up the 4% stake he held at the beginning of last year by 25%, with Highclere shown to be holding 5% on December 19 last.

In June 2017, when the shares were flying high at €4.15, Datalex was valued at €315m. At today’s share price of €1.25, Datalex is now valued at €94m. This €220m implosion represents a 70% paper write off.

For largest shareholder Dermo, the value of his 27% holding has collapsed by €60m from €86m to €28m. Loose change for Der Kaiser, but Paschal Taggart will find it harder to swallow the €7m loss to the value of his shareholding, down to €3m.

The big institutions like Capital only bought in in 2017 and have experienced a €15m paper loss, while Highclere will feel more bruised, having only topped up just before Christmas and, as a result, has suffered a €9m hit.

Aidan Brogan’s predecessor in the cockpit, Cormac Whelan, boarded in 2004. He was tasked not just with stabilising Datalex’s flight path, but strengthening its TDP airline booking engine platform. He did this over the following 10 years, spending $34m in the process.

Whelan also dramatically changed Datalex’s business model by adopting a transaction fee-based model in which an airline only paid for the bookings made.

Whelan left in September 2012 to be replaced by Aidan Brogan, who had been with Datalex for 18 years at that stage. Unlike Whelan, who was trained in software engineering, Brogan came from a sales background. This made it all the more surprising when he announced plans to double Datalex’s total staff by recruiting an additional 200 personnel to develop the company’s airline booking engine.

By this stage, investors would have believed Whelan had completed the main development work and that the platform was mature.

DIVERSITY

It is not clear what Brogan’s target was. Instead of adopting the focused approach of a dedicated airline booking engine platform software supplier ,with a high level of service and maintenance back-up, the CEO sought to move Datalex into more diverse areas. He entered into a strategic partnership with IBM, which was meant to be marketing Datalex’s booking engine alongside its cloud and, er, cognitive technology offerings. He also started a similar arrangement with Neusolt, one of the largest IT services operator in China.

Brogan also set up Datalex Labs in Silicon Valley with Jet Blue Technology Ventures, an offshoot of Jet Blue Airlines. The two partners planned to develop an application programme interface for airlines to evaluate Datalex’s products.

There was also a new venture in Shannon, where Datalex is working with Boeing to offer a service to assist new start-up aviation and travel operations.

It is hard to know just how much has gone wrong inside Datalex, but clearly things are worse than Moneybags previously suspected. Brogan claims to have 50 airlines as customers for Datalex’s booking engine platform. As the business model was meant to focus on developing recurring long-term revenue from each of its customers, the company should have little or no reliance on any one customer at this stage.

In these circumstances, there are a number of worrying items in the 2017 accounts. Rather than any revenue stream being spread relatively evenly across its customer base, the annual report identified that Datalex’s top two customers accounted for 40% of revenue in that year – an inexplicable statistic.

Dermot Desmond

An even more disturbing statistic is that one customer alone accounted for 47% of debtors at year end.

It was known that Datalex was doing an awful lot of work with the five airlines within the Lufthansa group and there are signs that this relationship has run into real turbulence, maybe in relation to Brogan’s over-optimistic target revenue. It is not wise for a group of Datalex’s size to pick a fight with a group as big as Lufthansa.

In relation to those accounting issues, it would be expected in the case of a software company that has been in business for 35 years that good practice would be for it to expense all its R&D costs when these arise, for most of this work will be associated with upgrading the existing platform. This is more in the nature of a revenue expense item rather than a capital development item.

Brogan has been doing exactly the opposite, building up staff numbers, now up to 269 with a wage cost of $28m, on top of outsourced work to consultants and contractors, which cost just on $26m in 2017. Total labour costs of $53m, for a company with total revenue of only $64m, looks unsustainable in principle, unless Brogan was developing new software products with incremental value.

The modest increase in revenue, however, suggests that Datalex is simply continuing to sell its existing platform and not new platforms.

The way Brogan dealt with this in 2017 was to capitalise a significant $13m of this spending, but only write off $5m from previous capitalised figures. If PwC adopts a strict approach and insists that Datalex writes off the cost of its claimed R&D expense, instead of the company claiming a $7m profit in 2017, it would actually show a loss of $1m. If, on top of this, some of the debtor recognition proves to be unsustainable, the loss in 2017 will have been worse and, presumably, worse again last year.

It is beginning to appear that Datalex is not quite the solid business that it was thought to be, with only 40% ($27m) out of its total claimed revenue in 2017 of $64m being long-term repeat revenue. With as much as $37m coming from one-off services delivered, these latter could be a big issue, particularly if these mostly come from a single huge client.

It is possible that Datalex shares are actually worth their current €1.25 but, if PwC comes out with a highly critical report, the initial reaction of investors could be to bale out.

Reference the Market Abuse Regulations 2005, nothing published by Moneybags in this section is to be taken as a recommendation, either implicit or explicit, to buy or sell any of the shares mentioned.